When buying a home, the excitement of finding the perfect property can sometimes cloud a person’s judgment. However, real estate professionals know that certain red flags can turn a dream home into a financial nightmare, and they know exactly what to look out for.

From foundation issues to high property taxes, there are many factors that can make a seemingly great property a costly and risky investment. Understanding these potential deal-breakers is very important to making an informed decision. Let’s take a look at what makes real estate pros think twice before sealing the deal.

1. Location Matters

Lincoln Edwards, a co-host of Austin Flipsters, says, “The location is the one thing you can’t change.” Edwards says to avoid homes that are on busy roads, near commercial buildings, or in poorly rated school districts. It is also very risky to invest in properties in high-crime areas.

Additionally, homes in flood, hurricane, or wildfire zones could come with high home insurance premiums. Even if the house is perfect inside, the location could reduce its resale potential and overall value. A less desirable neighborhood, no matter how nice the house is, can lead to prolonged time on the market and lower offers from buyers.

2. Foundation Problems

Signs of foundation issues, like sloping floors, cracks in walls, and stuck doors, should never be ignored. Chris Deziel, a home improvement writer with 30 years of experience, says these issues often indicate major structural problems.

Fixing foundation issues is not a small job. It might involve extensive repairs, such as lifting the house and rebuilding the foundation, which can be incredibly expensive. While you may be drawn to a home with charm, be prepared for significant expenses down the road if you buy a home that needs major foundation work.

3. Hazardous Materials

Mold is a common but serious issue in homes. Common signs of mold include peeling paint, a musty smell, and stained ceilings or walls. Mold thrives in damp, hidden areas and can pose significant health risks. Nick Gromicko, the founder of InterNACHI®, advises that if your inspector finds mold or other hazardous materials like asbestos or radon, it’s a solid reason to cancel the sale.

Mold removal can be expensive and requires professional help. If left uncontrolled, mold can also cause long-term health problems, making it a non-negotiable deal-breaker for any buyer concerned about their well-being.

4. Resale Value

Cathy Hirsch, a realtor with Better Homes and Gardens Real Estate, emphasizes the importance of considering resale value when buying a home. Issues like a house on a busy street, poor parking options, or a lack of essential features like a bathtub can turn off future buyers.

Even if these things don’t bother you personally, they could be deal-breakers for other people down the line. If you find yourself unable to sell or if you are forced to accept a low offer, you’ll regret not thinking ahead. Always consider how a home will perform in the market years down the road before sealing the deal.

5. Poor Craftsmanship

Homes with visible signs of poor craftsmanship, like uneven floors, exposed wires, or sloppy finishes, should raise red flags. Eddie Gutierrez, a real estate agent, suggests that these imperfections could point to larger hidden issues. It is also important to note that DIY projects done without proper permits could lead to legal complications and additional costs.

For example, unfinished basements or attic conversions could violate local building codes. If a property has a history of unpermitted work, be prepared for extra hassle. Getting permits afterward can be time-consuming, and you may need to undo some work to bring the property up to code.

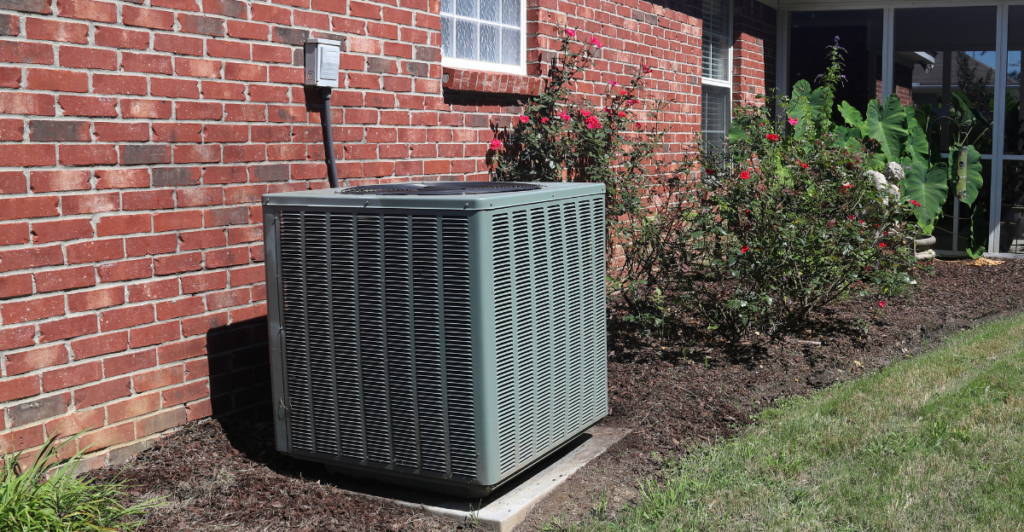

6. Old Systems

Even if a home’s systems, such as electrical, plumbing, or HVAC, are functioning, their age matters. As Nick Gromicko, a home inspector, points out, systems nearing or past their expected lifespan often need replacement. If the inspection reveals recurring issues with these systems, it’s a sign of potentially costly repairs in the near future.

Homebuyers should ask themselves if they’re prepared for these expenses. If two or more major systems need immediate attention, it might be better to walk away. Consider whether the price of replacing these systems fits into your budget before you commit to buying the property.

7. Termites

Termites can cause significant damage to a home’s structure. Termites will silently damage a property without immediate visible signs. Always be on the lookout for mud tubes along walls, holes in beams, or small piles of frass (termite droppings) around the house. Chris Deziel warns that termites can lead to major structural damage, including sloping floors and cracks in the walls.

If it is a big infestation, repairs could cost thousands of dollars, including rebuilding damaged beams and posts. Having a professional pest inspection is very important to determine the severity of the infestation. If the infestation is extensive, the cost of treatment and repair could outweigh the benefit of purchasing the house.

8. A Bad Roof

A damaged roof is one of the most expensive and time-consuming repairs a home can require. While Lincoln Edwards suggests that replacing a roof can add to a home’s value, it’s important to consider the full scope of the problem. Will Palmer, a real estate broker, points out that roofing issues can uncover hidden damage inside the home, like water leaks or structural problems.

If the roof’s condition suggests a larger underlying issue, it might be worth walking away. Repairing a roof is straightforward, but if it leads to further complications, it could mean a much larger financial burden than expected.

9. High Property Taxes

High property taxes can be a hidden financial burden that buyers often overlook. While a home might seem affordable initially, property taxes can significantly impact monthly payments and the overall cost of homeownership. These taxes can vary significantly depending on the location, and some areas may have rates that are much higher than others.

Chris Deziel, a home improvement expert, recommends researching the property tax rates in the area before making an offer. High taxes can affect your budget and could also indicate higher long-term costs. You should always factor in potential tax increases when considering a property.

Discover more trending stories and Follow us to keep inspiration flowing to your feed!

Craving more home and lifestyle inspiration? Hit Follow to keep the creativity flowing, and let us know your thoughts in the comments below!