Yale Budget Lab economists estimate that Trump’s tariff strategy could slash $3,800 a year from the average household’s purchasing power. With import taxes now hitting 125% on Chinese goods and a 10% baseline across the board, shoppers are bracing for impact.

Many are already shifting to “stock up” mode—though experts advise staying calm and making smart, forward-thinking purchases before price hikes hit harder in the months ahead.

Electronics: Your Next Smartphone Could Cost Triple

Tech products made in China may soon face tariffs as high as 125%, with analysts once warning iPhones could triple in cost. Though phones and laptops are temporarily exempt, policy shifts remain likely. Economist Diederik Stadig notes building new factories takes about a decade, meaning domestic production won’t bring quick relief. If you’re eyeing a tech upgrade within six months, buying now could help you avoid steep price jumps.

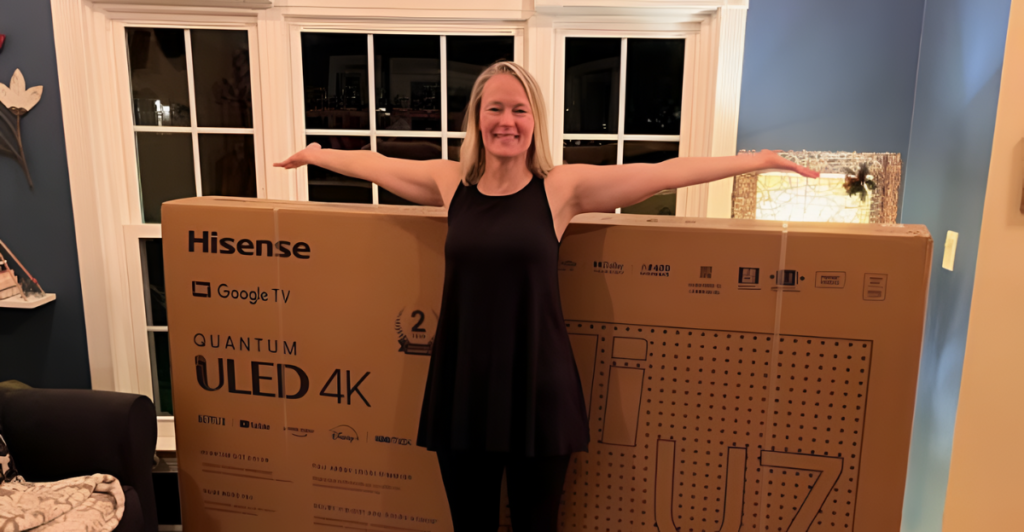

Home Appliances: The $178–$202 Premium Per Appliance

Household appliances face some of the steepest potential tariff increases. When tariffs hit washing machines previously, prices surged nearly 12% across the board. A $650 fridge could soon cost up to $852. Financial advisor Domenick D’Andrea suggests acting before the 90-day tariff delay ends—especially if your current machines are aging or you’re mid-renovation. Buying early could mean hundreds in savings before costs begin to climb.

Furniture: The 75% Imported Problem

Roughly 75% of furniture sold in the U.S. is imported, according to the Alliance for American Manufacturing. Trump’s recent order to open half of U.S. national forests to logging aims to boost domestic supply, but experts say the transition will be slow and costly. With lumber tariffs also in play, consumers furnishing their homes could face rising prices from both overseas supply constraints and limited local alternatives.

Toilet Paper & Paper Goods: Beyond Pandemic Hoarding

Toilet paper brands like Charmin and Scott may be U.S.-based, but they rely on imported raw materials—including wood pulp and lumber now facing tariffs. The pandemic showed how quickly paper goods can vanish from shelves. The Consumer Brands Association warns that “critical ingredients and inputs… need to be imported due to scarce availability domestically,” raising concerns that price hikes and shortages could return—even for American-made essentials.

Pantry Staples: Coffee, Spices & Canned Goods Seeing Early Rush

Panic buying is already underway. After tariff announcements, Consumer Edge reported surges in purchases of canned goods, instant coffee, and beer. “I’m purchasing double of everything—beans, canned items, flour, you name it,” said shopper Thomas Jennings, 53, to Reuters. Spices like black pepper, vanilla, and cinnamon are especially at risk due to their origins in countries facing reciprocal tariffs, making pantry basics an early casualty of rising trade tensions.

Seafood & Meat: The Canadian Connection Most Miss

Over half of the fresh red meat consumed in the U.S. comes from Canada, which could soon face 50% tariffs. That spells higher prices for burgers, steaks, and barbecue staples. Mexico—another key supplier, especially of nuts like almonds and peanuts—is also impacted. With tariffs hitting multiple food categories at once, American households may soon feel the pinch across an array of everyday protein sources.

The Strategic Shopper: When to Buy vs. When to Wait

Experts agree: avoid panic buying. Instead, focus on what you’ll need within six months. Certified financial planner Catherine Valega recommends acting early if major purchases—like cars or appliances—are already on your radar. Auto prices alone could rise by more than 8%. For non-urgent needs, waiting may be smarter. Patience, paired with careful planning, could help households navigate price volatility without overspending unnecessarily.

The Hidden Regressive Tax: Why Lower-Income Households Suffer Most

Tariffs hit lower-income families hardest. These households spend more on traded goods and face steeper percentage increases, especially on basic models. Federal Reserve and Harvard economists found tariffs are 1.2 percentage points higher on lower-cost versions of goods compared to luxury ones. That means essentials—not premium items—will bear the brunt of rising prices, placing the greatest strain on consumers who can least afford the increase.

Beyond Stockpiling: The Long Game in a Tariff Economy

Short-term stockpiling may ease immediate concerns, but living in a tariff-heavy economy demands longer-term strategy. Experts advise comparing prices, seeking domestic alternatives, and revising household budgets. A recent survey shows 72% of consumers have already changed their buying habits—delaying purchases, switching brands, or buying less. As these patterns take root, they’re expected to shape American consumer behavior far beyond this current round of tariffs.

Explore more of our trending stories and hit Follow to keep them coming to your feed!

Don’t miss out on more stories like this! Hit the Follow button at the top of this article to stay updated with the latest news. Share your thoughts in the comments—we’d love to hear from you!